Can You Buy Cryptocurrency? A Comprehensive Guide to Getting

Cryptocurrency has become a buzzword in the financial world, attracting the attention of investors, traders, and everyday people looking to diversify their assets. The question on many people's minds is, "Can you buy cryptocurrency?" The answer is yes, but the path to purchasing digital currencies involves several key steps, considerations, and understanding the landscape of cryptocurrencies.

In this detailed article, we will explore the various aspects of buying cryptocurrency, including how to get started, the different platforms available, essential security measures, potential risks, and advantages of investing in the crypto space. By the end of this guide, you'll feel equipped to make informed decisions about investing in cryptocurrencies.

Understanding Cryptocurrency: What Is It?

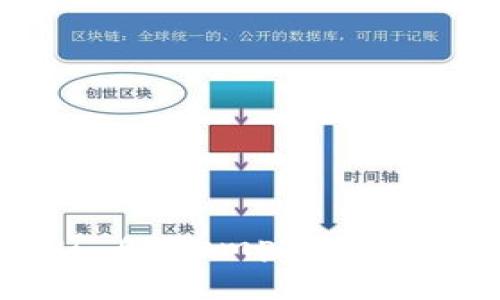

Before delving into the buying process, it's crucial to understand what cryptocurrency is. Cryptocurrency is a decentralized digital asset that uses cryptography for security. Unlike traditional currencies issued by governments (known as fiat currencies like the U.S. dollar or the Euro), cryptocurrencies operate on blockchain technology, which is a distributed ledger that records all transactions across a network of computers.

The most well-known cryptocurrency is Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies (often referred to as altcoins) have emerged, including Ethereum, Litecoin, Ripple, and many others. Each of these cryptocurrencies has unique features and functionalities.

Steps to Buy Cryptocurrency

If you're interested in buying cryptocurrency, here’s a step-by-step guide to get you started:

1. Choose Your Cryptocurrency

First, you need to decide which cryptocurrency you want to buy. Bitcoin remains the most popular choice, but depending on your research and investment goals, you might consider other options such as Ethereum for smart contracts, Binance Coin for trading, or Cardano for its technology and scalability.

2. Find a Cryptocurrency Exchange

Once you've chosen your cryptocurrency, you need to find a platform to purchase it. Cryptocurrency exchanges are online platforms where you can buy, sell, or trade cryptocurrencies. Some of the most popular exchanges include Coinbase, Binance, Kraken, and Bitstamp. When selecting an exchange, consider the following factors:

- Reputation: Look for exchanges that have a history of security and user satisfaction.

- Fees: Check the transaction fees, withdrawal fees, and deposit fees as they can vary significantly between exchanges.

- Available Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you wish to buy.

- User Interface: A user-friendly interface can significantly enhance your buying experience, especially as a beginner.

3. Create an Account

After selecting an exchange, you’ll need to create an account. This process typically involves providing your email address, creating a password, and completing identity verification, which may require uploading documents to comply with regulations such as Know Your Customer (KYC) laws.

4. Deposit Funds

Once your account is set up and verified, you need to deposit funds. Most exchanges allow you to deposit fiat currency through bank transfers, credit cards, or other payment methods. The time it takes for the money to appear in your account can vary depending on the method used, so it's good to check beforehand.

5. Buy Cryptocurrency

With funds in your exchange account, you can finally buy cryptocurrency. Navigate to the marketplace of your chosen cryptocurrency, input the amount you want to purchase, and confirm the transaction. Always double-check the details before finalizing the purchase, as transactions are irreversible.

6. Store Your Cryptocurrency

After buying cryptocurrency, consider where to store your digital assets. While you can leave them in your exchange wallet, it’s generally safer to transfer them to a personal cryptocurrency wallet. Wallets come in various forms, including:

- Hot Wallets: Connected to the internet, these wallets are convenient for frequent trades but are more vulnerable to hacking.

- Cold Wallets: Offline wallets, such as hardware wallets or paper wallets, offer more security and are recommended for long-term storage.

Potential Risks and Considerations

Investing in cryptocurrency carries several risks, and it's essential to be aware of them before entering the market:

1. Market Volatility

Cryptocurrencies are known for their high volatility. Prices can surge dramatically within a short period but can also plummet just as quickly. This volatility can result in significant profits or losses, so it's important to invest only what you can afford to lose.

2. Security Risks

The crypto space is susceptible to hacking, scams, and fraud. It's crucial to employ strong security measures, such as enabling two-factor authentication and using secure wallets, to protect your assets. Additionally, be wary of phishing scams that target unsuspecting investors.

3. Regulatory Environment

The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can affect the market significantly. Staying informed about regulatory developments is essential, as they can directly impact your investment.

Advantages of Buying Cryptocurrency

While there are risks, many investors are drawn to cryptocurrency for several reasons:

1. Diversification

Cryptocurrencies can provide a diversification option that traditional investments might not. They are not correlated with stock market movements and can potentially protect your portfolio during economic downturns.

2. Potential for High Returns

The cryptocurrency market has shown the potential for significant returns. Early investors in Bitcoin and Ethereum, for instance, have seen extraordinary gains. However, with high rewards comes high risk, and one should carefully consider their risk tolerance before investing.

3. Financial Inclusion

Cryptocurrencies can provide financial services to those who are unbanked or underbanked. With just an internet connection, anyone can access cryptocurrency markets, potentially reducing the reliance on traditional banking systems.

Frequently Asked Questions

1. Is it safe to buy cryptocurrencies?

Safety in cryptocurrency transactions largely depends on the platform and the precautions taken by the user. Using reputable exchanges, implementing two-factor authentication, and storing assets in secure wallets can mitigate risks. However, the inherent volatility and potential for hacking mean that caution is always advised.

2. Can I lose all my money investing in cryptocurrency?

Yes, investing in cryptocurrency carries significant risk, including the potential loss of your entire investment. Market volatility means that prices can change rapidly, and without proper risk management strategies, investors can suffer substantial losses. It’s advisable to only invest money that you can afford to lose and to have a diversified investment strategy.

3. How do I choose a cryptocurrency to invest in?

Choosing a cryptocurrency to invest in involves substantial research. Consider factors such as the project’s technology, market demand, the team behind the currency, and future use cases. Look into the community and growth potential of the cryptocurrency, and check reliable sources for data and analysis.

4. Can I buy cryptocurrency with a credit card?

Yes, many exchanges allow you to buy cryptocurrency with a credit card. However, your credit card issuer may treat cryptocurrency purchases as cash advances, which can result in high fees and interest rates. Be sure to check with your card issuer and carefully read the terms before proceeding with this payment method.

5. What are gas fees in cryptocurrency transactions?

Gas fees refer to the transaction fees paid to miners on the network to process and confirm transactions. These fees can vary depending on the network traffic and the specific cryptocurrency. For example, Ethereum uses gas fees for its transactions, which can fluctuate dramatically based on user demand. Understanding gas fees is crucial when trading, as these costs affect net gain or loss from a transaction.

In conclusion, buying cryptocurrency is indeed possible and can be done through various exchanges and platforms. It's essential to conduct thorough research and stay informed on the subject to navigate the complexities and opportunities within the crypto market successfully. Whether you are looking to invest for the long term or trade short-term, understanding the ins and outs of investing in cryptocurrencies will be crucial to your success.