### The Rise of Cryptocurrency in Africa: Perspectives and C

As the world becomes increasingly digital, cryptocurrency has emerged as a significant development in the financial landscape. Africa, a continent rich in diversity and potential, is finding its unique position in the evolving cryptocurrency market. The perception of cryptocurrency in Africa is shaped by various factors, including technological advancements, economic conditions, and the need for financial inclusion. This article explores how cryptocurrencies are viewed across the African continent, the opportunities they present, and the challenges they face.

Understanding Cryptocurrency in the African Context

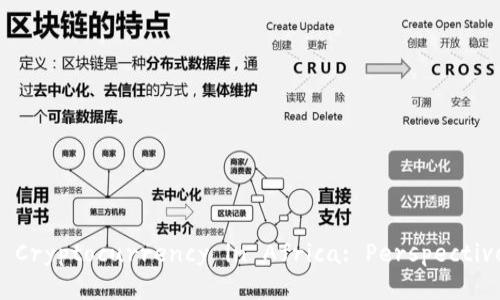

Cryptocurrency, at its core, represents a means of digital currency that relies on blockchain technology for secure and transparent transactions. In Africa, where a substantial portion of the population remains unbanked or underbanked, cryptocurrencies present a viable solution for financial inclusion. The decentralization offered by cryptocurrencies allows individuals to conduct transactions without the need for traditional banking infrastructure, which is often lacking in many regions.

Moreover, the high costs associated with remittances and sending money across borders in Africa have driven interest in cryptocurrencies. African nations often face significant fees for transferring money internationally, making cryptocurrencies a more appealing option for individuals seeking affordable alternatives. With increasing smartphone penetration and internet access, the continent is ready to embrace this digital financial revolution.

Current Trends in Cryptocurrency Adoption in Africa

The adoption of cryptocurrencies in Africa is on the rise. Countries such as Nigeria, South Africa, and Kenya are leading the pack in terms of cryptocurrency usage. Nigeria has emerged as one of the largest markets for Bitcoin on the continent, with a young population eager to engage in digital economies. Similarly, South Africa has established itself as a hub for blockchain technology and innovation, attracting startups and investors interested in cryptocurrency applications.

Peer-to-peer (P2P) trading platforms have also gained popularity in Africa, facilitating easier access to cryptocurrencies. These platforms allow users to trade directly with one another, bypassing traditional exchanges and adding a layer of convenience. In regions where access to banking is limited, P2P trading becomes an essential avenue for cryptocurrency transactions.

Advantages and Opportunities of Cryptocurrency in Africa

The advantages of cryptocurrency in Africa extend beyond mere financial transactions. One of the most significant benefits is its potential to promote financial inclusion. As mentioned earlier, a large segment of the African population lacks access to traditional banking services. Cryptocurrencies can bridge this gap by providing a decentralized means of saving, investing, and transferring value.

Furthermore, cryptocurrencies can enable micro-financing and encourage entrepreneurship among African youth. With the ability to raise capital through Initial Coin Offerings (ICOs) and crowd-funding without relying on conventional financial institutions, African innovators have the opportunity to bring their ideas to life. This shift towards a more inclusive financial ecosystem can contribute to economic growth and job creation on the continent.

Additionally, the blockchain technology underlying cryptocurrencies presents significant potential for various sectors, including agriculture, health, and governance. By leveraging blockchain, African nations can enhance transparency, reduce corruption, and improve supply chain management, ultimately leading to better economic outcomes.

Challenges to Cryptocurrency Adoption in Africa

Additionally, the lack of education and awareness about cryptocurrencies poses a barrier to adoption. While the younger generation may be enthusiastic about technology, many individuals remain unaware of how to safely buy, store, and use cryptocurrencies. Without proper education and resources, potential users may be hesitant to engage with digital currencies.

Another significant barrier is the volatility associated with cryptocurrencies. The price fluctuations of cryptocurrencies can make them less appealing as stable means of transaction and store of value. This instability can be detrimental in regions where economic environments are already turbulent, and communities seek reliable financial solutions.

Future Prospects for Cryptocurrency in Africa

The future of cryptocurrency in Africa looks promising. As digital literacy continues to improve and more individuals gain access to smartphones and the internet, the adoption of cryptocurrencies is likely to increase. Additionally, as African governments recognize the potential benefits of cryptocurrencies and blockchain technology, they may develop more supportive regulatory frameworks.

Moreover, the rise of Central Bank Digital Currencies (CBDCs) in various countries could synergize with the growth of cryptocurrencies. By integrating traditional finance with digital currencies, governments can promote innovation while maintaining control over monetary policy. This blended approach can potentially provide a safer transition into the world of cryptocurrencies for many users.

Lastly, the increasing interest from international investors and technology firms in Africa signals a growing recognition of the continent's potential in the crypto space. As investment flows increase, so too will the infrastructure surrounding cryptocurrency adoption, paving the way for further innovation and growth.

Common Questions About Cryptocurrency in Africa

As the conversation around cryptocurrency in Africa evolves, several questions arise concerning its impact and future prospects. Below are five crucial questions and detailed answers that address the pressing queries surrounding this topic:

1. How does cryptocurrency promote financial inclusion in Africa?

Cryptocurrency plays a pivotal role in addressing the financial inclusion gap in Africa. With over 60% of the continent's population unbanked or underbanked, cryptocurrencies offer a decentralized alternative to traditional banking systems. Individuals can send and receive money, engage in trade, and accumulate savings without the barriers imposed by conventional financial institutions.

The decentralized nature of cryptocurrencies allows users to bypass banking fees, attain faster transaction times, and access services that may not be available through traditional banks. For example, platforms like Bitcoin and Ethereum have enabled many to engage in microtransactions and remittances with little to no fees, making financial services more accessible to low-income individuals.

Moreover, cryptocurrencies can be particularly beneficial for rural populations that lack access to banking infrastructure. By using mobile technology to manage digital assets, users can transact and save through their smartphones, which are increasingly common even in remote areas. This capability not only empowers individuals with tools for financial resilience but also encourages entrepreneurship by providing access to capital through cryptocurrency-based funding methods.

2. What role does regulation play in the future of cryptocurrency in Africa?

Regulation serves as a double-edged sword for cryptocurrency in Africa. On one hand, clear, supportive regulations can foster innovation, protect users, and contribute to the legitimacy of the crypto ecosystem. On the other hand, overly stringent or ambiguous regulations may hinder adoption and development.

Currently, regulatory frameworks for cryptocurrencies in Africa vary significantly from country to country. Some nations like South Africa have embraced a more conducive regulatory environment, while others, such as Nigeria, have issued warnings or restrictions against cryptocurrency trading. The inconsistency can create confusion and deter potential users from engaging with digital currencies.

Moving forward, regulators must find a balance that encourages technological growth while ensuring consumer protection and financial stability. Establishing comprehensive regulations that address taxation, anti-money laundering (AML), and know your customer (KYC) policies will be critical for building trust in the cryptocurrency market. Collaborative efforts between governments, industry stakeholders, and the crypto community can lead to a regulatory framework that supports the responsible growth of digital currencies in Africa.

3. What technological barriers exist to widespread cryptocurrency adoption in Africa?

While the prospects for cryptocurrency in Africa are bright, several technological barriers remain that can impede widespread adoption. One of the significant hurdles is the lack of reliable internet access in various regions, particularly in rural areas. High-speed internet is often a prerequisite for seamless cryptocurrency transactions, and unreliable connectivity can discourage new users from engaging with digital currencies.

Additionally, the infrastructure for cryptocurrency exchanges and wallets may not be fully developed in many African countries. Responding to security concerns and ensuring user-friendly experiences are essential for building confidence among potential users. Many first-time users may feel intimidated by the complexity of wallets, private keys, and transaction processes, contributing to their reluctance to participate in the cryptocurrency market.

Lastly, issues related to cybersecurity present challenges for cryptocurrency adoption. Cyber threats, including hacking and phishing scams, can undermine trust in digital currencies. Building robust security measures and increasing public awareness regarding safe practices will be crucial for mitigating risks associated with using cryptocurrencies.

4. How can education and awareness impact cryptocurrency adoption in Africa?

Education and awareness play critical roles in fostering cryptocurrency adoption in Africa. A lack of understanding about how cryptocurrencies work, their benefits, and potential risks can lead to skepticism and hinder engagement. By providing accessible educational resources, individuals can feel more empowered to participate in the crypto market.

Initiatives that promote cryptocurrency literacy, such as workshops, seminars, and online courses, can significantly increase public knowledge about digital currencies. Educational content should focus on key topics such as blockchain technology, safe investment practices, wallet management, and identifying scams. As more individuals become educated about the opportunities and challenges associated with cryptocurrencies, they can make informed decisions about their financial strategies.

Furthermore, community-based programs can promote peer-to-peer learning, allowing experts and experienced users to share their insights with newcomers. Building a sense of community encourages collaboration and support, establishing a safer and more welcoming environment for potential users.

5. What is the potential impact of cryptocurrency on traditional financial systems in Africa?

The potential impact of cryptocurrency on traditional financial systems in Africa is multifaceted. As digital currencies become more prevalent, they may challenge traditional banking practices and drive financial institutions to adapt to meet changing consumer demands. Increased competition from cryptocurrencies could prompt banks to innovate their services, reduce fees, and enhance efficiency to retain clients.

Moreover, the rise of cryptocurrencies could bring more people into the financial system, creating opportunities for financial institutions to expand their reach. By integrating cryptocurrency services, banks may attract tech-savvy young individuals who prefer decentralized solutions, ultimately diversify their offerings, and cater to a broader audience.

However, this shift may also pose risks to traditional financial stability if not managed properly. Innovations in the cryptocurrency space could create regulatory challenges and affect monetary policy implementation. Balancing innovation with oversight will be essential as societies navigate the integration of cryptocurrency with their existing financial frameworks.

In conclusion, while Africa faces unique challenges in adopting cryptocurrencies, the continent also holds immense potential to leverage digital currencies for financial inclusion, innovation, and economic growth. As various stakeholders, from governments to educators, continue to invest in education, awareness, and effective regulations, Africa can lead the way in embracing the transformative power of cryptocurrencies in the years to come.